Improving Personal Finance takes center stage, beckoning readers with american high school hip style into a world of financial knowledge, ensuring an engaging and original reading experience. From budgeting strategies to retirement planning, this guide has it all.

Importance of Personal Finance

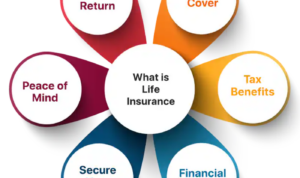

Personal finance is crucial for individuals as it involves managing and planning one’s financial resources effectively. It plays a significant role in helping individuals achieve their financial goals, build wealth, and secure their future.

Financial Stability

Maintaining good personal finance habits such as budgeting, saving, and investing can lead to financial stability. This stability provides a sense of security and peace of mind, knowing that you have the resources to cover unexpected expenses or emergencies.

Debt Management

By practicing good personal finance, individuals can effectively manage and reduce their debt. This includes paying off high-interest debts, avoiding unnecessary loans, and improving credit scores. Being debt-free or having manageable debt levels can lead to a stress-free financial situation.

Wealth Building

Good personal finance habits such as investing in diverse assets, saving for retirement, and setting financial goals can help individuals build wealth over time. By growing their assets and investments, individuals can secure their financial future and achieve financial independence.

Financial Freedom

Ultimately, good personal finance leads to financial freedom. This means having the ability to make choices based on personal goals rather than financial constraints. It allows individuals to enjoy life without being burdened by financial worries and limitations.

Budgeting Strategies

Budgeting is a crucial aspect of personal finance that can help individuals manage their money effectively. By creating a budget and tracking expenses regularly, you can ensure that you are living within your means and working towards your financial goals.

Different Methods for Creating an Effective Budget

- Zero-Based Budgeting: Assign every dollar a specific purpose, ensuring that your income minus expenses equals zero.

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Envelope System: Divide cash into envelopes for different spending categories to control overspending.

Importance of Tracking Expenses Regularly

Tracking expenses regularly is essential to understand where your money is going and identify areas where you can cut back or make adjustments. It allows you to stay on top of your spending habits and make informed decisions about your financial priorities.

Saving and Investing

Saving and investing are both important aspects of personal finance, but they serve different purposes. Saving involves setting aside money for short-term goals or emergencies, typically in a savings account, while investing is putting your money into assets with the expectation of generating a return over time.

Difference between Saving and Investing

- Saving is usually done for short-term goals or emergencies, providing a safety net for unexpected expenses.

- Investing, on the other hand, is focused on long-term growth and wealth building by putting your money into assets like stocks, bonds, or real estate.

- Savings accounts typically offer lower returns but are more stable and liquid, while investments carry more risk but have the potential for higher returns.

Tips for Starting to Save and Invest

- Set clear financial goals to determine how much you need to save and invest.

- Start by creating an emergency fund with 3-6 months’ worth of living expenses in a high-yield savings account.

- Consider automating your savings and investments by setting up automatic transfers from your paycheck to your savings or investment accounts.

- Educate yourself on different investment options and consider seeking advice from a financial advisor for personalized guidance.

- Diversify your investment portfolio to spread risk and maximize returns over the long term.

Managing Debt

Dealing with debt can be overwhelming, but with the right strategies, you can effectively manage and reduce it to improve your financial situation.

Consolidate High-Interest Debts

One way to manage debt is to consolidate high-interest debts into a lower-interest loan or credit card. This can help lower your overall interest payments and make it easier to pay off your debts faster.

Create a Repayment Plan

Developing a repayment plan can help you prioritize which debts to pay off first. You can choose between the snowball method, where you pay off the smallest debts first, or the avalanche method, where you tackle the debts with the highest interest rates first.

Avoid Impulse Spending

To prevent falling into more debt, it’s essential to avoid impulse spending. Create a budget, track your expenses, and only spend on necessary items to avoid adding more debt to your plate.

Build an Emergency Fund

Having an emergency fund can help you cover unexpected expenses without relying on credit cards or loans. Aim to save at least three to six months’ worth of living expenses to provide a safety net in case of financial emergencies.

Seek Professional Help

If you’re struggling to manage your debt on your own, consider seeking professional help from a credit counselor or financial advisor. They can provide personalized advice and guidance to help you get on track towards a debt-free future.

Emergency Funds: Improving Personal Finance

In the world of personal finance, having an emergency fund is crucial for financial stability and peace of mind. Emergency funds are savings set aside specifically for unexpected expenses or financial emergencies that may arise.

Building and Maintaining an Emergency Fund, Improving Personal Finance

Building an emergency fund requires discipline and consistency. Start by setting a goal for how much you want to save, typically 3 to 6 months’ worth of living expenses. Cut back on unnecessary expenses and redirect that money towards your emergency fund.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund to ensure regular contributions.

- Choose a high-yield savings account: Opt for a savings account that offers a higher interest rate to help your emergency fund grow faster.

- Use windfalls wisely: Any unexpected bonuses, tax refunds, or gifts can be directed towards your emergency fund to boost savings.

- Replenish after use: If you ever dip into your emergency fund, make it a priority to replenish the amount as soon as possible to maintain its intended purpose.

Financial Goals Setting

Setting financial goals is crucial for achieving financial success. It helps individuals stay focused, track progress, and make informed decisions about their money. Here is a step-by-step guide on how to set realistic financial goals:

Step 1: Assess Your Current Financial Situation

Start by evaluating your income, expenses, assets, and debts. Understanding where you stand financially will help you set achievable goals.

Step 2: Define Your Goals

Clearly define what you want to achieve financially. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, make sure your goals are specific and measurable.

Step 3: Set SMART Goals

Make sure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to save money,” say “I want to save $5,000 for a vacation in one year.”

Step 4: Create an Action Plan

Break down your goals into smaller, actionable steps. Determine how much money you need to save each month, cut expenses, increase income, or invest wisely to reach your goals.

Step 5: Track Your Progress

Regularly monitor your finances to see if you are on track to meet your goals. Adjust your plan if necessary and celebrate small victories along the way.

Step 6: Stay Motivated

Stay motivated by visualizing the benefits of achieving your goals. Keep reminding yourself why you set these goals in the first place and stay committed to your financial journey.

Credit Score Improvement

Maintaining a good credit score is crucial for your financial health and can impact your ability to borrow money, get approved for a credit card, rent an apartment, or even secure a job. Your credit score is a numerical representation of your creditworthiness based on your credit history.

Understanding Credit Score

A credit score is a three-digit number typically ranging from 300 to 850 that reflects your credit risk based on your credit report. It is calculated using various factors such as payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries.

Tips for Improving Credit Score

- Pay your bills on time: Timely payments are crucial for a good credit score. Late payments can significantly impact your score.

- Keep credit card balances low: Aim to utilize only a small portion of your available credit to maintain a healthy credit utilization ratio.

- Avoid opening too many new accounts: Opening multiple new accounts within a short period can lower your average account age and negatively impact your score.

- Regularly check your credit report: Monitor your credit report for errors or fraudulent activity that could harm your credit score.

- Use different types of credit: Having a mix of credit accounts, such as credit cards, installment loans, and a mortgage, can positively impact your credit score.

- Consider a secured credit card: If you have a limited credit history or poor credit, a secured credit card can help you build or rebuild your credit score.

Retirement Planning

Planning for retirement is crucial to ensure financial stability and security in your later years. It involves setting aside a portion of your income during your working years to support yourself when you no longer have a steady paycheck coming in.

Significance of Retirement Planning

Retirement planning is essential because it allows you to maintain your desired lifestyle after you retire. Without proper planning, you may struggle to cover your expenses and medical bills, leading to financial stress and hardship in your golden years. By starting early and saving consistently, you can build a nest egg that will provide you with the financial freedom to enjoy retirement.

Strategies for Effective Retirement Planning

- Start saving early: The sooner you begin saving for retirement, the more time your money has to grow through compound interest.

- Calculate your retirement needs: Estimate how much money you will need in retirement based on your desired lifestyle and expenses.

- Contribute to retirement accounts: Take advantage of employer-sponsored retirement plans like 401(k)s and individual retirement accounts (IRAs) to maximize your savings.

- Diversify your investments: Spread your retirement savings across different asset classes to reduce risk and ensure a more stable return.

- Regularly review and adjust your plan: Monitor your retirement savings and adjust your contributions as needed to stay on track with your goals.