Startup funding options set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset. Traditional funding sources, alternative methods, and government grants all play a role in shaping the financial landscape for startups.

Types of Startup Funding Options

When it comes to funding a startup, there are several options available for entrepreneurs to explore. Each type of funding comes with its own set of pros and cons, so it’s essential to understand the differences between them before making a decision.

Debt Financing vs. Equity Financing

Debt financing involves borrowing money that needs to be repaid with interest over a specific period. This can be in the form of loans from banks or financial institutions. On the other hand, equity financing involves selling a stake in the company to investors in exchange for capital. This means that investors become part owners of the business and share in its profits.

- Debt Financing:

- Pros: No equity dilution, interest payments are tax-deductible.

- Cons: Monthly repayments, risk of default if business fails.

- Equity Financing:

- Pros: No repayment required, investors share risk and reward.

- Cons: Equity dilution, loss of control over decision-making.

Bootstrapping

Bootstrapping is another funding option where entrepreneurs use their savings or revenue generated by the business to fund its growth. While this method allows for complete control over the business, it can limit the speed and scale at which the startup can grow.

Bootstrapping is like pulling yourself up by your own bootstraps – it’s all about self-reliance and making the most of what you have.

Traditional Funding Sources: Startup Funding Options

When it comes to traditional funding sources for startups, there are a few key players that entrepreneurs often turn to for financial support. Angel investors, venture capitalists, and bank loans are some of the most common options available.

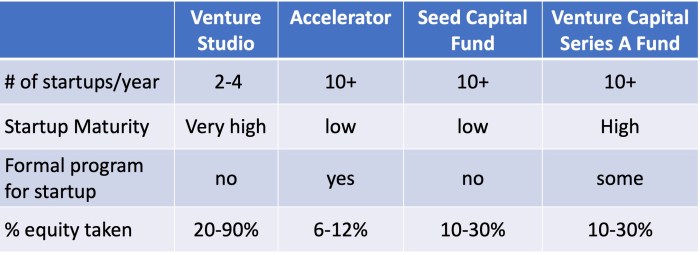

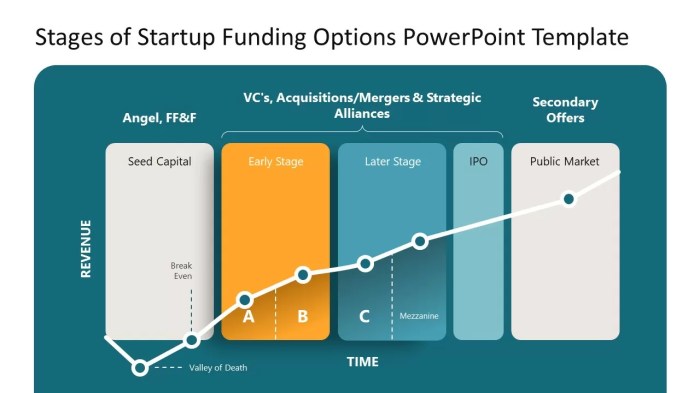

Angel investors typically contribute to startup funding by providing capital in exchange for equity in the company. These individuals are usually wealthy individuals who are looking to invest in early-stage companies with high growth potential. Angel investors can offer not only financial support but also valuable expertise and connections to help the startup succeed.

Venture capitalists play a similar role in supporting startup growth, but on a larger scale. These firms manage pooled funds from investors and invest in startups that have the potential for significant returns. Venture capitalists are often involved in later-stage funding rounds and can provide substantial amounts of capital to fuel a startup’s growth and expansion.

Securing a bank loan for startup funding involves applying for a loan from a financial institution. Startups must present a solid business plan, financial projections, and collateral to demonstrate their ability to repay the loan. Bank loans can be a good option for startups that have a strong credit history and are looking for a more traditional form of funding.

Alternative Funding Methods

Crowdfunding has emerged as a popular non-traditional approach to startup funding. It involves raising small amounts of money from a large number of people, typically through online platforms. This method allows startups to reach a wider audience and secure funding without relying solely on traditional sources like banks or investors.

Crowdfunding

Crowdfunding platforms such as Kickstarter and Indiegogo have enabled startups to showcase their ideas and products to a global audience. By creating compelling campaigns and offering rewards or equity in return for funding, entrepreneurs can tap into the power of the crowd to finance their ventures.

Revenue-Based Financing

Revenue-based financing is a unique funding model where startups receive capital in exchange for a percentage of their future revenues. Unlike traditional loans, there are no fixed monthly payments, and repayment is based on the company’s performance. This method aligns the interests of investors with those of the startup, as they both benefit from the company’s growth.

Accelerators and Incubators

Accelerators and incubators are organizations that provide startups with funding, mentorship, and resources to help them grow and succeed. These programs typically culminate in a demo day where startups pitch their ideas to investors. By participating in accelerators and incubators, startups can access valuable support and networking opportunities to accelerate their growth.

Government Grants and Support

Government grants and support can be vital resources for startups looking to get off the ground and grow their business. These programs can provide funding, mentorship, and other forms of assistance to help startups succeed in their early stages.

Different Government Grants Available

- Federal Grants: Offered by various government agencies at the federal level to support specific industries or projects.

- State Grants: Each state may have its own grant programs to support local startups and businesses.

- Local Grants: City or county governments may also offer grants to encourage economic development and entrepreneurship.

Eligibility Criteria for Startups

- Registered Business: Startups must be legally registered entities to qualify for government grants.

- Industry Focus: Some grants are specific to certain industries or sectors, so startups must meet the eligibility criteria.

- Financial Need: Demonstrating a need for funding and a solid business plan are often requirements for grant applications.

Government Support Programs for Startups, Startup funding options

- Accelerator Programs: Government-supported accelerators offer mentorship, networking opportunities, and funding to help startups grow.

- Incubator Programs: These programs provide workspace, resources, and support to startups in their early stages.

- Loan Programs: Some government agencies offer low-interest loans to startups to help them finance their operations.