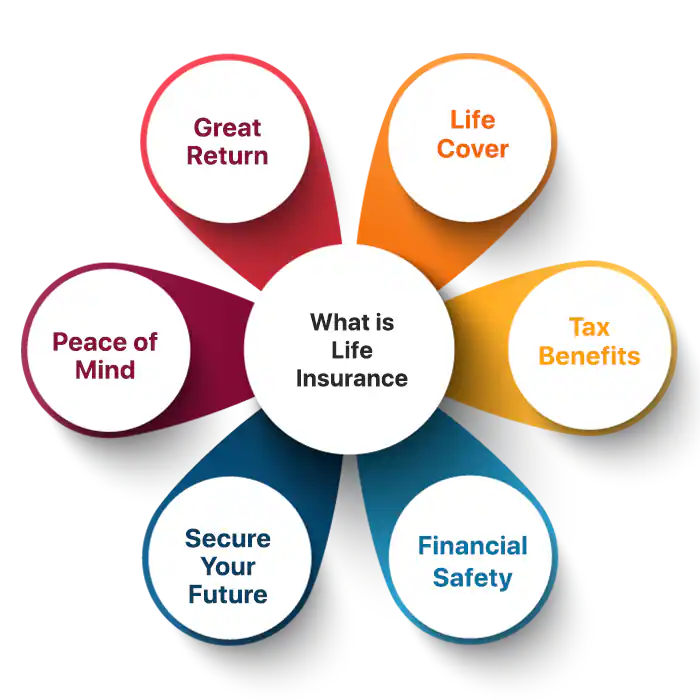

Life insurance plans are a crucial aspect of financial planning, providing security and peace of mind for individuals and their loved ones. Let’s dive into the world of life insurance and explore the different types, factors to consider, importance, myths, and more.

Types of Life Insurance Plans

Life insurance plans come in various types to suit different needs and preferences. One of the most popular options is term life insurance, which provides coverage for a specific period of time, typically 10, 20, or 30 years. This type of insurance is affordable and straightforward, making it a popular choice for young families or individuals looking for temporary coverage.

Term Life Insurance

Term life insurance offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. It does not accumulate cash value like other types of insurance, but it provides pure protection at a lower cost. This type of insurance is ideal for those who want coverage for a specific period, such as until their children are grown or their mortgage is paid off.

Whole Life Insurance

Whole life insurance, on the other hand, is a permanent type of insurance that provides coverage for the entire lifetime of the insured. It also accumulates cash value over time, which can be borrowed against or used to supplement retirement income. While whole life insurance premiums are higher than term life insurance, the coverage is guaranteed as long as premiums are paid.

Universal Life Insurance

Universal life insurance is another type of permanent insurance that offers more flexibility than whole life insurance. It allows policyholders to adjust their premium payments and death benefits to suit their changing needs. Universal life insurance also accumulates cash value, which grows tax-deferred and can be accessed during the policyholder’s lifetime.

Each type of life insurance plan serves a different purpose and caters to specific financial goals. Term life insurance is best for temporary needs, such as providing income replacement or paying off debts. Whole life insurance is suitable for long-term financial protection and estate planning, while universal life insurance offers flexibility and cash value growth potential. It’s essential to consider your individual circumstances and financial objectives when choosing the right life insurance plan for you.

Factors to Consider Before Choosing a Life Insurance Plan: Life Insurance Plans

When selecting a life insurance plan, there are several key factors to keep in mind to ensure you choose the right coverage for your needs.

Age and Health Condition

Age and health condition play a significant role in determining the type of life insurance plan that is suitable for you. Younger individuals typically have lower premiums as they are considered lower risk. On the other hand, individuals with pre-existing health conditions may have to pay higher premiums or may have limited coverage options.

Importance of Coverage Amount and Duration

The coverage amount and duration are crucial factors to consider before choosing a life insurance plan. You should evaluate your financial obligations, such as mortgage payments, debts, and future expenses, to determine the appropriate coverage amount. Additionally, consider the duration of the policy to ensure it aligns with your long-term financial goals.

Tips on Evaluating Financial Stability of an Insurance Provider, Life insurance plans

Before selecting an insurance provider, it is essential to assess their financial stability to ensure they can fulfill their obligations in the future. Look for ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, or Moody’s to gauge the financial strength of the insurance company. Additionally, review customer reviews and complaints to understand the level of service provided by the insurer.

Importance of Life Insurance

Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your passing. It ensures that your beneficiaries are financially secure and can maintain their standard of living even after you are no longer there to provide for them.

Financial Security for Beneficiaries

Life insurance can provide a lump sum payment to your beneficiaries upon your death, helping them cover expenses such as mortgage payments, education costs, and daily living expenses. This financial security can offer peace of mind during a difficult time and prevent your loved ones from facing financial hardship.

- Life insurance can help replace your income and ensure that your family can maintain their lifestyle.

- It can cover funeral expenses and outstanding debts, relieving your loved ones of financial burdens.

- Life insurance can also be used to pay off your mortgage or other loans, ensuring that your family can remain in their home.

Tax Benefits of Life Insurance

Life insurance policies often come with tax benefits that can help you save money in the long run. The death benefit paid out to your beneficiaries is typically tax-free, providing them with a significant sum without any tax implications. Additionally, the cash value component of permanent life insurance policies can grow tax-deferred, allowing you to build wealth over time without paying taxes on the gains.

Remember that tax laws may vary depending on your location, so it’s essential to consult with a financial advisor to understand the specific tax benefits of your life insurance policy.

Life Insurance as an Investment Tool

In addition to providing financial protection, life insurance can also serve as an investment tool. Permanent life insurance policies, such as whole life or universal life insurance, accumulate cash value over time that you can access through policy loans or withdrawals. This cash value can be used for various purposes, such as supplementing retirement income, funding a child’s education, or covering unexpected expenses.

- By investing in a permanent life insurance policy, you can benefit from the dual advantage of protection and potential growth of your cash value.

- Some policies offer dividends or interest payments on the cash value, allowing you to increase your overall returns.

- Using life insurance as an investment tool can provide you with a diversified asset that can help you achieve your financial goals while protecting your loved ones.

Common Myths about Life Insurance Plans

When it comes to life insurance, there are several myths that can prevent individuals from making informed decisions about their financial future. Let’s debunk some of the most common misconceptions surrounding life insurance.

Life Insurance is Not Just for Older Individuals

Contrary to popular belief, life insurance is not just for older individuals. In fact, it is essential for individuals of all ages who want to protect their loved ones financially in case of an unexpected event like illness or accidents. Younger individuals can benefit from lower premiums and better health conditions when they start a life insurance policy early.

Life Insurance is Too Expensive

One of the biggest myths about life insurance is that it is too expensive. The truth is, life insurance can be affordable, especially if you choose the right plan that fits your budget and coverage needs. There are various options available, such as term life insurance, which can provide adequate coverage at a reasonable cost.

Life Insurance is Unnecessary for Single Individuals

Another misconception is that life insurance is unnecessary for single individuals without dependents. However, life insurance can still be valuable for covering funeral expenses, paying off debts, or leaving a legacy to loved ones. It can also provide financial protection in case of disability or critical illness, ensuring that single individuals have a safety net in place.