When it comes to renter’s insurance options, buckle up for a ride through the world of coverage choices and protection plans. From understanding the basics to navigating the complexities, this guide has got you covered.

Get ready to dive into the details of different policies, debunk common myths, and uncover key factors that influence rates. By the end, you’ll be equipped to make informed decisions about safeguarding your rented space.

Renter’s Insurance Overview

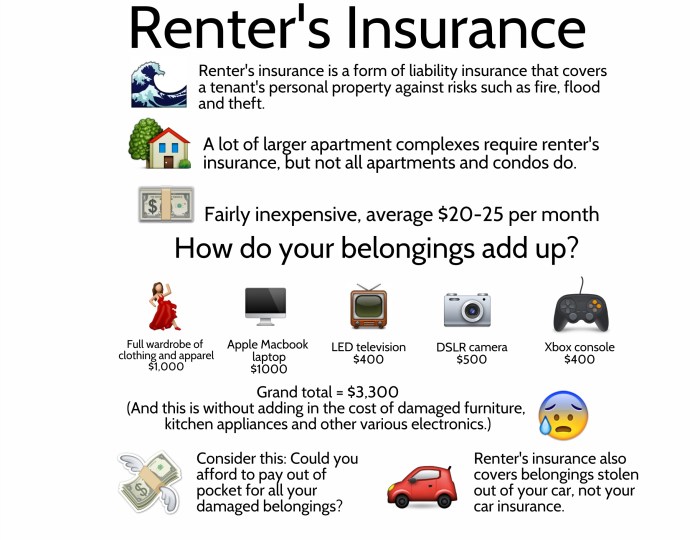

Renter’s insurance is a type of insurance policy designed specifically for tenants who are renting a property. It provides coverage for the renter’s personal belongings and liability protection in case of accidents or damage within the rented space.

Importance of Renter’s Insurance

Renter’s insurance is crucial for tenants as it offers financial protection in case of unforeseen events like theft, fire, or natural disasters. Without renter’s insurance, tenants could be left with no coverage for their personal belongings or liable for damages within the rented property.

Coverage Options in Renter’s Insurance

- Personal Property Coverage: This protects the renter’s belongings such as furniture, electronics, and clothing from covered perils.

- Liability Coverage: Provides protection in case someone is injured within the rented property and the renter is found legally responsible.

- Additional Living Expenses: Covers the cost of temporary living arrangements if the rented property becomes uninhabitable due to a covered event.

Common Misconceptions about Renter’s Insurance

-

“My Landlord’s Insurance Covers Me”: Many tenants mistakenly believe that their landlord’s insurance will protect their personal belongings, but this is not the case.

-

“Renter’s Insurance is Expensive”: In reality, renter’s insurance is quite affordable, with policies starting at a few dollars a month.

-

“I Don’t Have Enough Stuff to Insure”: Even if you don’t own expensive items, renter’s insurance can still provide liability protection and coverage for basic belongings.

Types of Renter’s Insurance Policies: Renter’s Insurance Options

When it comes to renter’s insurance policies, there are a few key types to consider. Let’s dive into the details to help you understand the differences and options available.

Actual Cash Value vs. Replacement Cost Policies

- Actual Cash Value: This type of policy will reimburse you for the value of your belongings at the time they were damaged or stolen, minus depreciation. It may result in receiving less money than what you initially paid for the items.

- Replacement Cost: With this policy, you will be reimbursed for the full cost of replacing your belongings with new items of similar kind and quality, without considering depreciation. Although the premiums may be higher, you may receive a higher payout in case of a claim.

Named Perils vs. All-Risk Coverage

- Named Perils: This type of coverage only protects you from specific risks that are explicitly listed in the policy. If the cause of damage or loss is not included in the list, you may not be covered.

- All-Risk Coverage: Also known as comprehensive coverage, this policy offers protection from all risks except those that are specifically excluded. It provides broader coverage compared to named perils, offering more peace of mind for renters.

Additional Coverage Options, Renter’s insurance options

When considering renter’s insurance, it’s important to think about adding extra coverage for specific risks like floods or earthquakes. These natural disasters are typically not covered under standard policies, so adding on this protection can provide additional security and financial support in case of unforeseen events.

Personal Property Coverage in Renter’s Insurance

- Renter’s insurance typically includes personal property coverage, which helps reimburse you for the cost of replacing or repairing your belongings if they are damaged, destroyed, or stolen. It’s important to document your possessions and their value to ensure you receive proper compensation in the event of a claim.

Factors Influencing Renter’s Insurance Rates

When it comes to determining renter’s insurance rates, there are several key factors that insurance companies take into consideration. These factors play a significant role in how much you will pay for coverage. Let’s explore some of the main influences on renter’s insurance rates.

Location of the Rented Property

The location of the rented property is a crucial factor that can greatly impact insurance premiums. Properties located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are considered higher risk by insurance companies. As a result, renters in these locations may face higher insurance rates compared to those in areas with lower risk of such events.

Deductible Chosen by the Renter

The deductible chosen by the renter also plays a significant role in determining the insurance premium. A deductible is the amount of money that the policyholder must pay out of pocket before the insurance coverage kicks in. Typically, choosing a higher deductible will result in lower insurance premiums, as the renter is taking on more of the financial risk in the event of a claim.

Tips to Lower Insurance Rates

– Consider bundling your renter’s insurance with other policies, such as auto insurance, to potentially receive a discount from the insurance company.

– Installing safety features in your rental property, like smoke detectors, security alarms, or deadbolts, can help reduce the risk of incidents and lower your insurance rates.

– Maintaining a good credit score can also impact your insurance rates, as some insurance companies use credit-based insurance scores to determine premiums.

– Shop around and compare quotes from different insurance providers to ensure you are getting the best rate possible for your renter’s insurance coverage.

Choosing the Right Renter’s Insurance

When it comes to choosing the right renter’s insurance, there are several important steps to consider to ensure you have the appropriate coverage for your needs. It’s crucial to review the coverage limits and policy exclusions before making a purchase and consider bundling renter’s insurance with other policies for potential discounts. Tenants should also assess their coverage needs to guarantee they are adequately protected.

Review Coverage Limits and Policy Exclusions

Before purchasing renter’s insurance, it is essential to carefully review the coverage limits and policy exclusions. Make sure you understand what is covered and what is not, so there are no surprises when you need to file a claim. Pay close attention to any specific exclusions that may impact your coverage.

Consider Bundling with Other Policies

One way to save money on renter’s insurance is to bundle it with other insurance policies, such as auto or life insurance. Many insurance companies offer discounts for customers who have multiple policies with them. By bundling, you can potentially lower your overall insurance costs while still maintaining sufficient coverage.

Assess Your Coverage Needs

To ensure you have the right amount of coverage, take the time to assess your coverage needs. Consider the value of your belongings, the potential risks in your area, and any additional coverage options you may want to add, such as coverage for high-value items or liability protection. By evaluating your needs, you can tailor your policy to provide the protection you need.