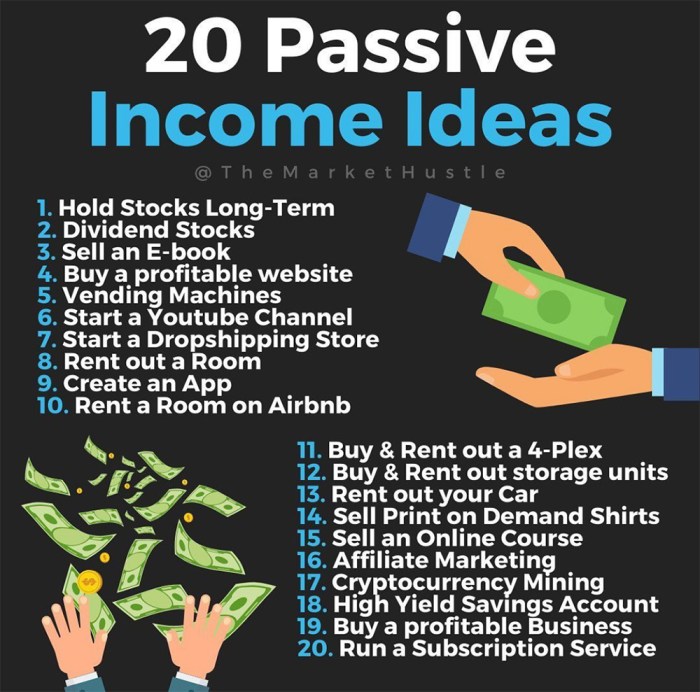

Passive Income Ideas are all the rage, offering a way to make money while you sleep. From real estate to online businesses, explore various strategies to boost your income effortlessly.

Whether you’re a budding entrepreneur or a seasoned investor, this guide will walk you through the ins and outs of generating passive income and why it’s crucial for your financial well-being.

Introduction to Passive Income Ideas

Passive income is money earned with minimal effort through a variety of ventures or investments. Unlike active income, which requires constant work to maintain, passive income continues to generate revenue even when you’re not actively working.

Having passive income offers numerous benefits, such as financial stability, flexibility, and the potential to achieve financial goals. It can provide an additional source of income, reduce financial stress, and create opportunities for wealth accumulation over time.

Importance of Passive Income in Financial Planning

Passive income plays a crucial role in financial planning by diversifying income streams, reducing reliance on a single source of income, and creating a more secure financial future. It allows individuals to build wealth, save for retirement, and achieve financial independence.

Real Estate as a Passive Income Idea

Investing in real estate is a popular way to generate passive income, with rental properties being a key avenue for potential earnings. Landlords can earn money each month from rental payments without having to actively work for it, making it a desirable source of passive income.

Real estate investments offer several advantages compared to other passive income streams. Unlike traditional investments like stocks or bonds, real estate provides tangible assets that can appreciate over time. Additionally, rental properties can generate consistent cash flow through monthly rent payments, offering a steady income stream.

However, real estate investments also come with risks. Property values can fluctuate based on market conditions, impacting the potential return on investment. Landlords may also face challenges such as property maintenance, tenant turnover, and vacancies, which can affect their passive income earnings.

Despite the risks, real estate investments can offer significant rewards. In addition to rental income, landlords can benefit from property appreciation over time, potentially increasing their overall wealth. By carefully selecting properties, managing them efficiently, and staying informed about market trends, investors can maximize their passive income potential through real estate ventures.

Online Business and Passive Income

Creating an online business can be a lucrative way to generate passive income. With the rise of e-commerce and digital marketing, there are various opportunities to explore in this space.

Online Store for Passive Income

- Setting up an online store through platforms like Shopify or Etsy can provide a passive income stream.

- By selling products or services online, you can reach a global audience and make money around the clock.

- Automating processes like order fulfillment and customer service can help make your online store truly passive.

Affiliate Marketing as a Passive Income Strategy

- Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral.

- By creating content such as blog posts, videos, or social media posts that include affiliate links, you can earn passive income when your audience makes a purchase.

- Choosing the right affiliate programs and products to promote is crucial for success in affiliate marketing.

Scalability of Online Businesses for Generating Passive Income

- One of the key advantages of online businesses is their scalability.

- With the right strategies in place, you can grow your online business and increase your passive income potential exponentially.

- Scaling an online business may involve expanding product lines, investing in marketing, or optimizing your website for better conversions.

Investment Opportunities for Passive Income: Passive Income Ideas

Investing is a key strategy for generating passive income over time. By putting your money to work for you, you can build a steady stream of income without having to actively work for it. Let’s explore some popular investment opportunities for passive income.

Dividend Investing and its Passive Income Potential

Dividend investing involves buying shares of companies that pay out dividends to their shareholders. These dividends are a portion of the company’s profits distributed to investors, providing a regular income stream without the need to sell the shares.

Investing in dividend-paying stocks can be a reliable way to generate passive income, as you receive regular payouts simply for owning the shares. Over time, you can reinvest these dividends to compound your earnings and grow your investment portfolio.

Index Funds for Passive Income Generation

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500. By investing in index funds, you can gain exposure to a diversified portfolio of stocks without the need to pick individual companies.

Index funds offer a passive way to invest in the stock market, as they require minimal maintenance and offer broad market exposure. They can be an effective way to generate passive income through capital appreciation and dividends from the underlying stocks.

Peer-to-Peer Lending as an Alternative Passive Income Source

Peer-to-peer lending platforms connect borrowers with individual lenders, allowing you to earn interest by lending out your money to others. This alternative investment opportunity can provide a passive income stream through regular interest payments.

While peer-to-peer lending carries some risks, such as default on loans, it can offer higher returns compared to traditional savings accounts or bonds. By diversifying your lending across multiple borrowers, you can mitigate risk and potentially earn a solid passive income.

Passive Income through Content Creation

Creating and monetizing content online has become a popular way to generate passive income. Whether it’s through a blog, YouTube channel, or creating digital products, content creators have various opportunities to earn money passively.

Monetizing a Blog or YouTube Channel

Creating a successful blog or YouTube channel requires consistent and engaging content that attracts a loyal audience. Once you have built a following, you can monetize your platform through various methods such as advertising, sponsored content, affiliate marketing, and selling merchandise. By leveraging your audience and providing valuable content, you can earn passive income from your blog or YouTube channel.

Creating and Selling Digital Products

Digital products such as e-books, online courses, templates, and stock photos are excellent sources of passive income for content creators. By creating high-quality digital products that cater to your audience’s needs, you can set up automated systems for selling and delivering these products. This allows you to earn passive income while focusing on creating more content.

Passive Income in the Gig Economy

The gig economy has opened up new opportunities for content creators to earn passive income through freelance work. Platforms like Fiverr, Upwork, and Freelancer offer a marketplace for freelancers to offer their services and generate passive income. By leveraging your skills and expertise, you can create a steady stream of passive income through freelance work in the gig economy.

Passive Income from Royalties and Licensing

Royalties and licensing can be lucrative sources of passive income for creators and owners of intellectual property. When you create something original, like a book, music, or artwork, you can earn royalties by allowing others to use or reproduce your work. Licensing your intellectual property involves granting permission to others to use your creations in exchange for a fee.

Royalties from Books, Music, or Art

- Authors can earn royalties from book sales, where they receive a percentage of each sale.

- Musicians can earn royalties from streaming services, radio play, or sales of their music.

- Artists can earn royalties from the sale of prints, merchandise, or licensing their artwork for commercial use.

Licensing Intellectual Property, Passive Income Ideas

- Licensing allows creators to expand the reach of their work by granting permission for others to use it.

- Creators can negotiate licensing agreements that specify how their work can be used, for what purposes, and for how long.

- Licensing can provide a steady stream of passive income without the creator having to actively promote or sell their work.

Protecting Rights when Earning Passive Income through Royalties

- Creators should consider copyrighting their work to protect it from unauthorized use or reproduction.

- It’s important to review licensing agreements carefully to ensure that your rights are protected and that you are fairly compensated.

- Seek legal advice if needed to navigate complex licensing agreements and protect your intellectual property rights.

Passive Income through Automated Investing

Automated investing offers a hands-off approach to growing your wealth and generating passive income. By leveraging robo-advisors, dollar-cost averaging, and diversification strategies, you can create a sustainable source of passive income over time.

Robo-Advisors: Streamlining Your Investments

Robo-advisors are automated platforms that use algorithms to manage your investment portfolio. These platforms analyze your financial goals, risk tolerance, and time horizon to create a diversified portfolio tailored to your needs. With low fees and minimal human intervention, robo-advisors provide a convenient way to invest for passive income.

Dollar-Cost Averaging: Building Wealth Over Time

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps smooth out the impact of market volatility and allows you to accumulate assets over time. By consistently investing in the market, you can benefit from compounding returns and grow your passive income steadily.

Importance of Diversification in Automated Investing

Diversification is key to reducing risk and maximizing returns in automated investing. By spreading your investments across different asset classes, industries, and regions, you can mitigate the impact of market fluctuations on your portfolio. Diversification ensures that no single investment has a disproportionate impact on your overall returns, helping you build a resilient source of passive income.