Writing a Personal Finance Blog sets the stage for a deep dive into the world of financial literacy, offering insights and strategies to captivate readers and build a thriving online community. Get ready to explore the art of crafting compelling content in the realm of personal finance!

Introduction to Personal Finance Blogging

Personal finance blogging is a platform where individuals share their insights, tips, and advice on managing money, budgeting, investing, and achieving financial goals. These blogs cater to a wide audience looking to improve their financial literacy and make informed decisions about their finances.

The Importance of Financial Literacy, Writing a Personal Finance Blog

Financial literacy plays a crucial role in today’s society as it empowers individuals to make sound financial decisions, plan for the future, and navigate the complexities of the financial world. Lack of financial knowledge can lead to debt, poor money management, and missed opportunities for growth and wealth accumulation.

Examples of Successful Personal Finance Blogs

- The Penny Hoarder: Known for its practical money-saving tips and advice on earning extra income, The Penny Hoarder has amassed a large following seeking financial guidance.

- Mr. Money Mustache: This blog focuses on early retirement and financial independence through frugality and smart investing, inspiring readers to rethink their approach to money.

- Get Rich Slowly: Offering a mix of personal stories, expert advice, and practical tips, Get Rich Slowly helps readers build wealth over time and achieve their financial goals.

Identifying Target Audience: Writing A Personal Finance Blog

To successfully run a personal finance blog, it is crucial to identify your target audience. Understanding who your readers are will help you tailor your content to meet their specific needs and goals.

Demographics and Psychographics

- Determine the age group of your audience. Are they young adults just starting their careers or are they nearing retirement?

- Consider the income levels of your audience. Are they high earners looking for investment opportunities or are they on a tight budget trying to save money?

- Think about the education level of your audience. Do they have a basic understanding of financial concepts or are they looking for more advanced strategies?

- Look at the psychographics of your audience. What are their financial goals? Are they looking to build wealth, get out of debt, or simply improve their financial literacy?

Understanding the demographics and psychographics of your audience will help you create content that resonates with them and provides value.

Importance of Understanding Audience’s Financial Needs and Goals

- By knowing your audience’s financial needs, you can address common pain points and provide solutions that are relevant to them.

- Understanding your audience’s financial goals will help you create content that motivates and guides them towards achieving those goals.

- Tailoring your content to meet the specific needs and goals of your audience will increase engagement and build a loyal following.

Choosing Relevant Topics

When it comes to writing a personal finance blog, selecting relevant topics is key to engaging your audience and providing valuable information. Here are some tips to help you choose the best topics to write about and stay up-to-date on current financial trends and news.

Research Current Financial Trends

To keep your content fresh and relevant, it’s essential to stay informed about the latest financial trends. Follow reputable financial news websites, subscribe to newsletters, and set up Google alerts for relevant s to ensure you are up-to-date on the latest developments.

Identify Your Audience’s Needs

Consider your target audience’s financial goals, challenges, and interests when brainstorming content ideas. Tailor your topics to address their specific needs and provide solutions to common financial problems they may face.

Brainstorm Unique Content Ideas

To stand out in the crowded personal finance blogging space, brainstorm unique content ideas that offer a fresh perspective or insightful advice. Consider sharing personal finance success stories, practical budgeting tips, investment strategies, or ways to save money creatively.

Collaborate with Experts

Collaborating with financial experts, such as certified financial planners or investment advisors, can offer valuable insights and expertise to your blog. Consider interviewing professionals in the field or inviting guest bloggers to share their knowledge and experience with your audience.

Writing Engaging Content

When it comes to writing engaging and informative content for a personal finance blog, it’s essential to keep your audience in mind. You want to provide valuable information in a way that is easy to understand and relatable. Here are some tips to help you create compelling blog posts:

Using a Conversational Tone

One of the keys to engaging your audience is to use a conversational tone in your writing. Avoid using jargon or complex financial terms that may alienate readers. Instead, strive to communicate in a clear and friendly manner. This will help make your content more accessible and enjoyable to read.

- Avoid using technical terms without explaining them first.

- Use real-life examples and stories to illustrate your points.

- Engage with your readers by asking questions or encouraging comments.

- Keep your tone positive and encouraging to motivate your audience.

Structuring Blog Posts for Readability and User Engagement

The way you structure your blog posts can significantly impact their readability and user engagement. Here are some tips to help you organize your content effectively:

- Start with a compelling introduction to grab the reader’s attention.

- Use subheadings to break up your content and make it easier to digest.

- Include bullet points or numbered lists to highlight key takeaways.

- Incorporate images, graphs, or infographics to enhance visual appeal.

Incorporating Visuals and Multimedia

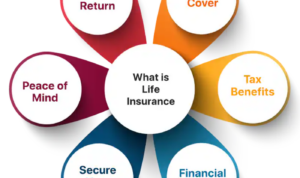

When it comes to personal finance blogging, incorporating visuals and multimedia can take your content to the next level. Visual elements like infographics, charts, and videos not only make your blog posts more visually appealing but also help in conveying complex financial concepts in a more digestible manner for your audience.

Benefits of Including Visuals

- Visuals grab attention: Eye-catching graphics can attract readers and encourage them to engage with your content.

- Enhanced understanding: Visual aids help in breaking down complicated financial topics into simpler, easy-to-understand visuals.

- Increased shareability: Posts with visuals are more likely to be shared on social media platforms, increasing your blog’s reach.

Sourcing and Creating Visual Content

- Utilize free online tools: Platforms like Canva and Piktochart offer easy-to-use templates for creating infographics and graphics.

- Outsource to professionals: If design is not your forte, consider hiring a graphic designer to create visually appealing content for your blog.

- Use stock images and videos: Websites like Unsplash and Pexels offer high-quality, royalty-free images and videos that you can use to enhance your blog posts.

Optimizing Images and Videos for

- Use descriptive filenames: Rename your image files using relevant s to improve search engine optimization.

- Add alt text: Include descriptive alt text for images to improve accessibility and help search engines understand the content of your visuals.

- Optimize image size: Compress images to reduce loading times and improve site speed, which can positively impact rankings.

Monetization Strategies

When it comes to making money from your personal finance blog, there are several strategies you can explore to turn your passion into profit. From affiliate marketing to sponsored content and even creating digital products, there are various avenues to monetize your blog. However, it’s essential to maintain transparency with your audience throughout the monetization process to build trust and credibility. Here are some tips on how to effectively monetize your personal finance blog while cultivating a loyal readership to support your efforts.

Affiliate Marketing

Affiliate marketing is a popular monetization strategy where you promote products or services from other companies on your blog. You earn a commission for every sale or lead generated through your unique affiliate link. To succeed in affiliate marketing, choose products that align with your blog’s niche and audience’s interests. Be honest in your reviews and recommendations to maintain trust with your readers.

Sponsored Content

Sponsored content involves partnering with brands to create blog posts, videos, or social media posts promoting their products or services. It’s crucial to disclose any sponsored content to your audience to maintain transparency. When selecting sponsored opportunities, ensure they resonate with your blog’s values and provide value to your readers. Remember, authenticity is key in sponsored content to retain the trust of your audience.

Digital Products

Creating and selling digital products like e-books, online courses, or financial planning templates can be a lucrative way to monetize your personal finance blog. Develop products that address your audience’s pain points and offer practical solutions. Promote your digital products through engaging content and email marketing campaigns to drive sales. Providing valuable resources can help you establish authority in your niche and attract a loyal customer base.

Building a Community

Building a community around a personal finance blog is crucial for creating a loyal following, fostering engagement, and providing support and encouragement to readers on their financial wellness journey.

Engaging with Readers

Engaging with readers through comments, social media, and email newsletters is key to building a strong community around your personal finance blog. Here are some strategies to consider:

– Respond promptly to comments on your blog posts to show that you value your readers’ input and feedback.

– Use social media platforms to share your blog content, engage with followers, and start conversations around financial topics.

– Create a regular email newsletter to provide exclusive content, updates, and personalized tips to your subscribers.

Fostering a Supportive Community

To foster a supportive and interactive community focused on financial wellness, consider the following:

– Encourage open discussions about financial challenges, goals, and successes to create a safe space for readers to share their experiences.

– Organize virtual events such as webinars, Q&A sessions, or workshops to provide valuable information and facilitate community interaction.

– Collaborate with other personal finance bloggers or experts to offer diverse perspectives and insights to your community members.